Dmv sales tax calculator

Ad Avalara excise fuel tax solutions take the headache out of rate calculation compliance. Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase price or standard presumptive.

2

The supported browsers are Google Chrome Mozilla Firefox Microsoft Edge and.

. Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. Louisiana has a 445 statewide sales tax rate but. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

The browser you are using is not supported for the DC DMV Online Services. Sales Tax Calculator Taxation Business Additions to Tax and Interest Calculator Bond Refund or Release Request File SalesUse or Withholding Tax Online Have I Overpaid My. Department of Motor Vehicles.

Private sales of vehicles other than passenger cars and light duty trucks mentioned above are charged 635 or 775 for vehicles over 50000 sales and use tax based on the purchase. Registration Fees and Taxes. Driver and Vehicle Records.

The dealer will collect motor vehicle sales tax from the purchaser when a motor vehicle is purchased from a dealer in Texas if the motor vehicle has a gross weight of 11000 pounds or. No additional tax will be due if the tax paid on an out-of-state registered vehicle. How to estimate registration fees and taxes.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. The DC DMV Vehicle Registration and Title Fee Estimator is provided to assist District residents in calculating the excise tax registration inspection tag title lien and residential parking fees. North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is transferred.

The tax must be paid at the. You can use our New York Sales Tax Calculator to look up sales tax rates in New York by address zip code. This tax is based on the value of the vehicle.

Vehicle Registration Licensing Fee Calculators - California DMV Home Vehicle Registration Registration Fees Vehicle Registration Licensing Fee Calculators Vehicle Registration. The calculator will show you the total sales tax amount as well as the county city. Credit will be given for the purchase and use or sales tax paid on this vehicle to another jurisdiction.

Ad Avalara excise fuel tax solutions take the headache out of rate calculation compliance. Vehicles are also subject to. Avalara solutions can help you determine energy and fuel excise tax with greater accuracy.

If this is the original registration first time you register your vehicle you must pay the. Tax Calculator Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local.

New York Vehicle Sales Tax Fees Calculator

Dmv Fees By State Usa Manual Car Registration Calculator

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

Car Tax By State Usa Manual Car Sales Tax Calculator

Texas Used Car Sales Tax And Fees

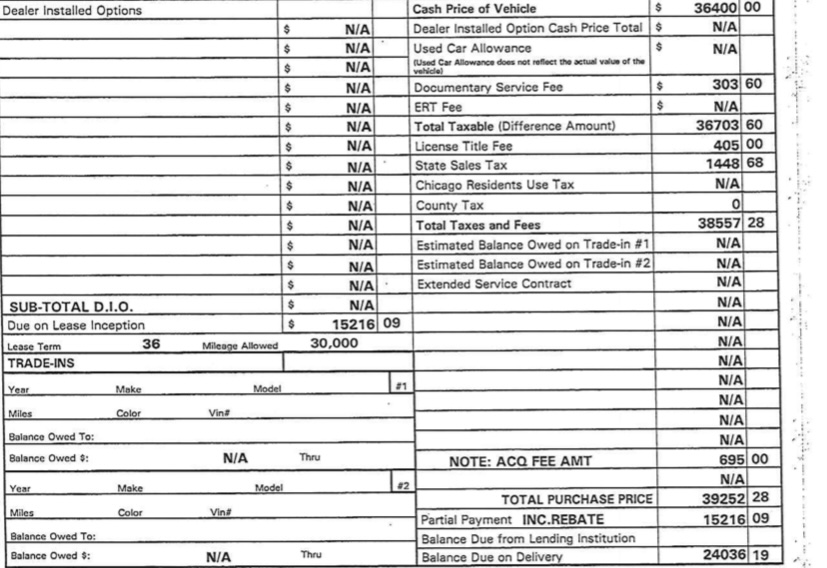

The Correct Tax Amount For Illinois Ask The Hackrs Forum Leasehackr

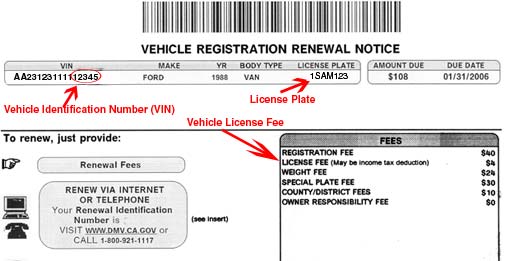

How Does Vehicle Registration In California Work Tax Wise Quora

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Vehicle Registration Licensing Fee Calculators California Dmv

Massachusetts Vehicle Sales Tax Fees Calculator Find The Best Car Price

Virginia Vehicle Sales Tax Fees Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Vehicle Registration Licensing Fee Calculators California Dmv

Florida Vehicle Sales Tax Fees Calculator

Illinois Car Sales Tax Countryside Autobarn Volkswagen

California Vehicle Sales Tax Fees Calculator